missoula montana sales tax rate

The US average is 46. Estimated Combined Tax Rate 000 Estimated County Tax Rate 000 Estimated City Tax Rate 000 Estimated Special Tax Rate 000 and Vendor Discount -----NA-----.

Blockchain Climate Damage And Death Policy Interventions To Reduce The Carbon Emissions Mortality And Net Zero Implications Of Non Fungible Tokens And Bitcoin Sciencedirect

If you need specific tax information or property records about a property in Missoula County contact the Missoula County Tax Assessors Office.

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)

. And Friday 900 am. This pristine home features over 3000 sq ft. This means that depending on your location within Montana the total tax you pay can be significantly higher than the 0 state sales tax.

Has impacted many state nexus laws and sales tax collection requirements. 368 rows Average Sales Tax With Local. While many other states allow counties and other localities to collect a local option sales tax Montana does not permit local sales taxes to be collected.

Montana has a 0 statewide sales tax rate but also has 73 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0002 on top of the state tax. The Montana MT state sales tax rate is currently 0. The Missoula Montana sales tax is NA the same as the Montana state sales tax.

The December 2020 total. Wayfair Inc affect Montana. Local-option tax rates are set by the county up to a maximum of 3 on medical adult-use or both.

The Department of Revenue a division of the State of Montanas government determines the market value of residential and commercial property once every two years. The Montana state sales tax rate is 0 and the average MT sales tax after local surtaxes is 0. There are additional taxes.

14 hours ago5 Bedroom Home in Lolo - 559000. The median property tax in Montana is 146500 per year for a home worth the median value of 17630000. Download all Montana sales tax rates by zip code.

Sales Tax and Use Tax Rate of Zip Code 59802 is located in Missoula City Missoula County Montana State. Montana is ranked number twenty nine out of the fifty states in order of the average amount of property taxes collected. - Tax Rates can have a big impact when Comparing Cost of Living.

0 State Sales tax is -----NA-----. Sales Tax and Use Tax Rate of Zip Code 59812 is located in Missoula City Missoula County Montana State. The US average is 28555 a year.

Sales Tax and Use Tax Rate of Zip Code 59806 is located in Missoula City Missoula County Montana State. Look up 2022 sales tax rates for East Missoula Montana and surrounding areas. The US average is 73.

Exact tax amount may vary for different items. Income and Salaries for Missoula - The average income of a Missoula resident is 25275 a year. If you need help working with the department or figuring out our audit appeals or relief processes the Taxpayer Advocate can help.

Were available Monday through Thursday 900 am. Estimated Combined Tax Rate 000 Estimated County Tax Rate 000 Estimated City Tax Rate 000 Estimated Special Tax Rate 000 and Vendor Discount -----NA-----. Did South Dakota v.

Tax rates last updated in April 2022. Estimated Combined Tax Rate 000 Estimated County Tax Rate 000 Estimated City Tax Rate 000 Estimated Special Tax Rate 000 and Vendor Discount -----NA-----. State taxes are set by the Montana Legislature while local-option taxes are optionally enacted by counties.

Modern Farmhouse turn key meticulously kept home in Lolo. 2022 Montana Sales Tax Table. The Montana sales tax rate is currently.

2022 Montana state sales tax. Tax Rates for Missoula - The Sales Tax Rate for Missoula is 00. While Montana has no statewide sales tax some municipalities and cities especially large tourist destinations charge their own local sales taxes on most purchases.

362 013 341st of 3143 093 003 1250th of 3143 Note. Counties in Montana collect an average of 083 of a propertys assesed fair market value as property tax per year. These taxes are in addition to the state taxes.

9 rows Montana has a 0 sales tax and Missoula County collects an additional NA so the minimum. The Missoula sales tax rate is. The state sales tax rate in Montana is 0 but you can.

Upon entrance you are greeted. The notices for the 2019-2020 appraisal cycle are. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount.

Sales Tax and Use Tax Rate of Zip Code 59803 is located in Missoula City Missoula County Montana State. - The Income Tax Rate for Missoula is 69. Estimated Combined Tax Rate 000 Estimated County Tax Rate 000 Estimated City Tax Rate 000 Estimated Special Tax Rate 000 and Vendor Discount -----NA-----.

There is 0 additional tax districts that applies to some areas geographically within Missoula. With 5 beds and 3 baths. The 2018 United States Supreme Court decision in South Dakota v.

Montana has no state sales tax and allows local. Montana is one of only five states without a general sales tax. The County sales tax rate is.

This page provides general information about property taxes in Missoula County. The Missoula sales tax rate is NA. State taxes are set at 4 for medical marijuana and 20 for adult-use sales.

0 State Sales tax is -----NA-----. 4 rows The current total local sales tax rate in Missoula MT is 0000. 0 State Sales tax is -----NA-----.

0 State Sales tax is -----NA-----. The value of your property directly affects the property taxes you pay to schools Missoula County and the City of Missoula. Tax rates are provided by Avalara and updated monthly.

Sales tax region name.

Montana Income Tax Mt State Tax Calculator Community Tax

State And Local Sales Tax Rates 2013 Map Income Tax Property Tax

Montana Income Tax Mt State Tax Calculator Community Tax

Montana Income Tax Mt State Tax Calculator Community Tax

Our Experienced Advisers Can Help With Hongkong Staff Employment Regulations And Contractual Terms To Internal Communications Business Names Human Resources

The Initiative That Could Upend Montana S Tax System Missoula Current

Montana Sales Tax Rates By City County 2022

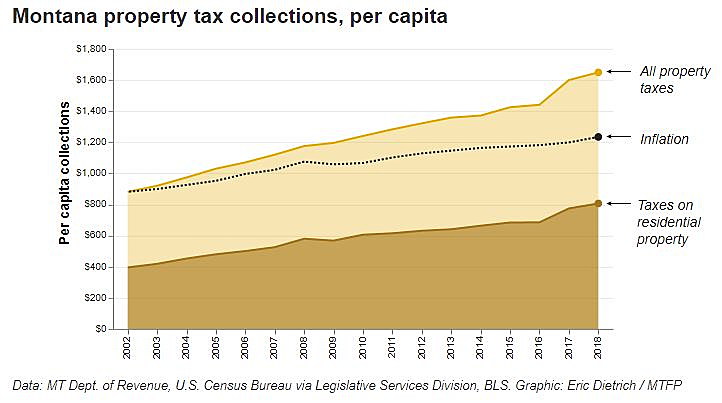

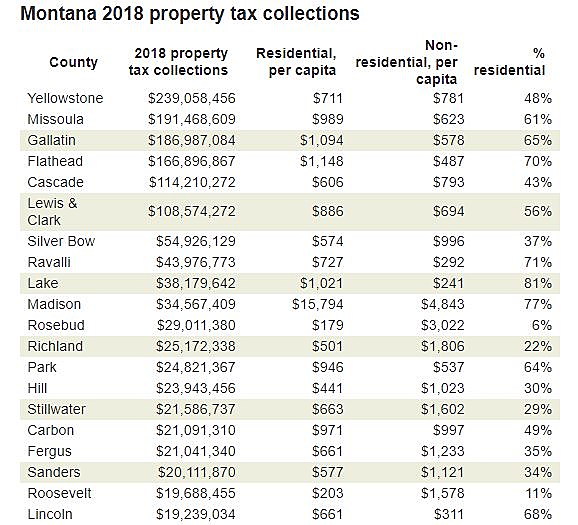

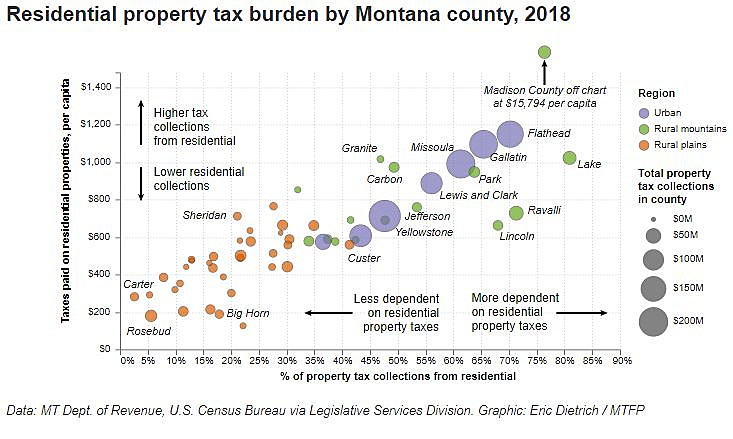

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current

Nevada Oregon Office Of Economic Analysis

Mapsontheweb Infographic Map Map Sales Tax

How Much Does Your State Collect In Sales Taxes Per Capita Sales Tax State Tax Tax

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)