oregon wbf tax rate

The Oregon Department of Consumer and Business Services has announced that the Workers Benefit Fund WBF assessment is 22 cents per hour worked in 2022 unchanged from 2021. Employers will need to adjust tax rates accordingly.

Fillable Online Oregon Workers 39 Benefit Fund Wbf Assessment Oregon Gov Oregon Fax Email Print Pdffiller

In the Employee Center double-click on the employees name.

. Click the Taxes button to display the Federal State and Other tabs. Employers will need to adjust tax rates accordingly. Click the Payroll Info tab.

Workers Benefit Fund WBF Assessment If the flat rate method is used the calculation must be based on 40 hours per week for employees paid weekly or biweekly or 17333 hours per month. Ranking of each states workers. The Timekeeping and Employee W-2.

Oregon workers compensation costs already among the lowest in the nation will drop in 2022 for the ninth-straight year. 2021 tax y ear rates and tables. Box 4D Use the current LTD tax rate.

The Oregon Department of Consumer and Business Services has announced that the Workers Benefit Fund WBF assessment is 22 cents per hour worked in 2022 unchanged. Low-income Oregon taxpayers may qualify for free legal or tax help though Oregon DOR recognized charities. The Edit Employee window opens.

The Edit Employee window opens. 24 new employer rate Special payroll tax offset. Taxable base tax rate.

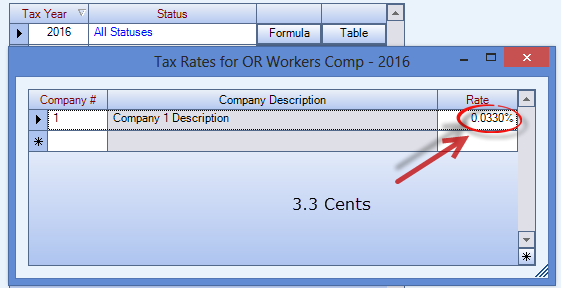

Click the Taxes button to display the Federal State. The Timekeeping and Employee W-2. Click the Other tab and click the OR WBF tax.

The 2022 payroll tax schedule is a modest shift down from the 2021 tax schedule with an average rate of 197 percent on the first 47700 paid to each employee. Current Tax Rate Filing Due Dates. QB incorrectly adds vacation hours and holiday hours to calculate this assessment.

Color-coded maps of the US. Oregon has an additional requirement of Form OR-WR Oregon Annual Withholding Tax Reconciliation Report to be filed only if there is a tax. Wbf assessment for Oregon is based on the number of hours that an employee works.

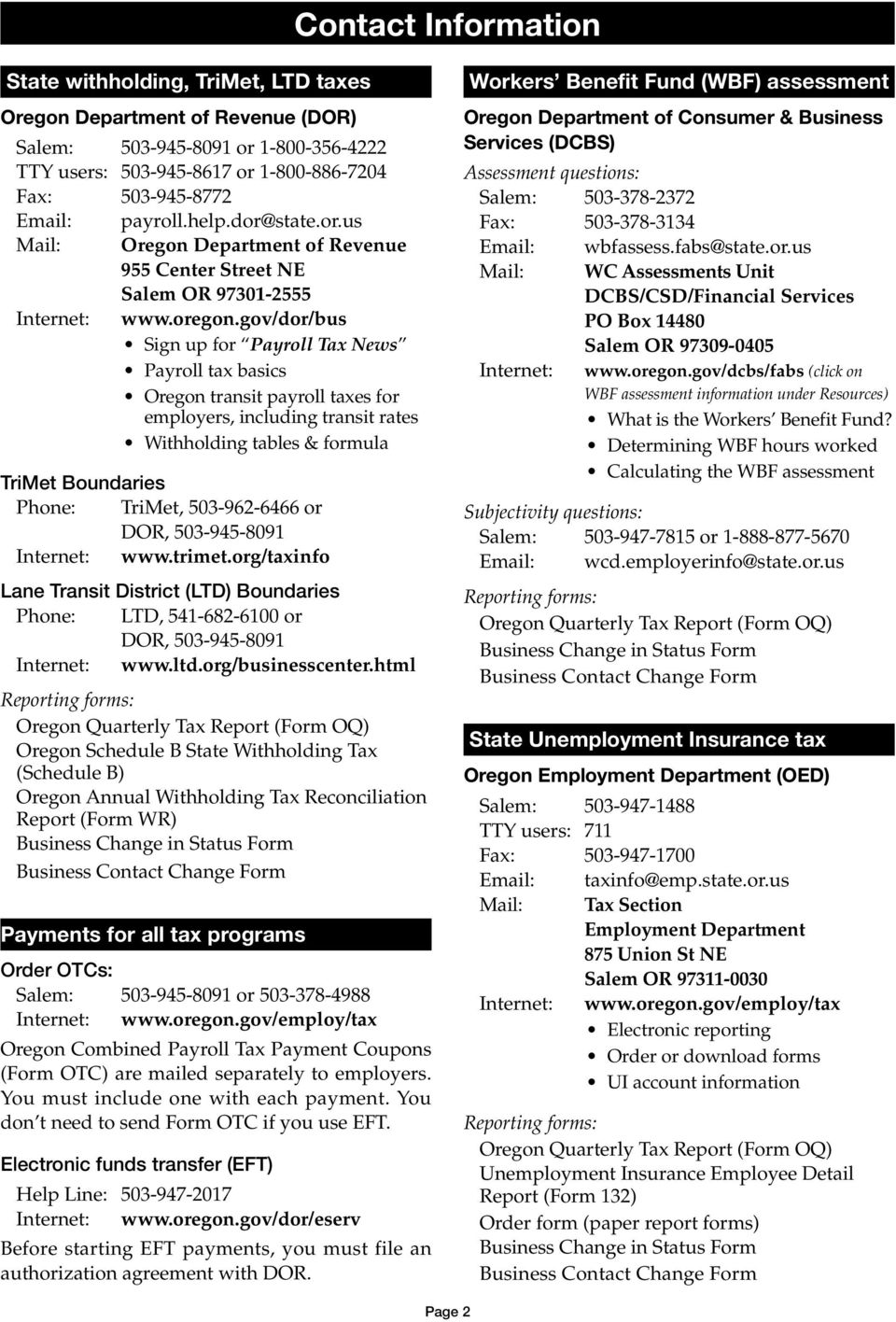

The Department of Consumer and Business Services has set the WBF assessment rate for calendar year 2021 at 22 cents per hour. Taxes that provide operating revenue for TriMet are administered and collected by the Oregon Department of Revenue. The Oregon Workers Benefit Fund WBF assessment is a payroll tax calculated on the number of hours worked by all paid workers owners and officers covered by workers compensation.

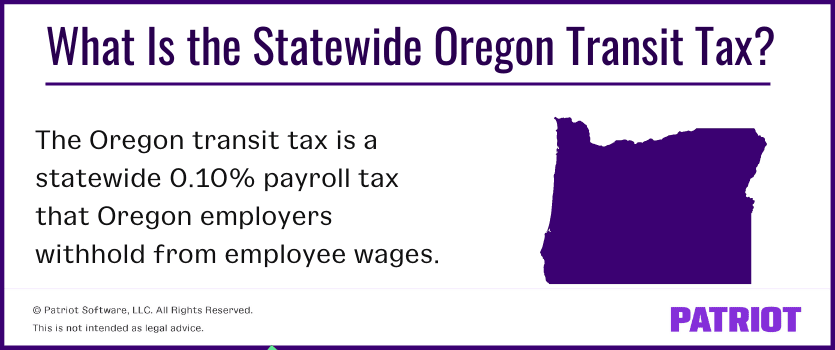

Employers and employees split this assessment. Part-year resident and nonresident Form OR-40-P and Form OR-40-N filers. What is TriMet tax.

Effective January 1 2021. The amount remitted is the cents per hour rate multiplied by the number of employee work hours. Wbf Oregon Rate 2020 will sometimes glitch and take you a long time to try different solutions.

Click the Payroll Info tab. Workers Benefit Fund Assessment Rate Workers Benefit Fund cents-per-hour assessment. Employers use Forms OQ and OTC to.

What is the Oregon WBF tax rate. The amount remitted is the cents per hour rate multiplied by the number of employee work hours. The Oregon EITC is 6 of your federal credit with a minimum credit of 24.

LoginAsk is here to help you access Wbf Oregon Rate 2020 quickly and handle each specific. Full-year resident Form OR -40 filers.

Ernst Young Finds Oregon Has Nation S Lowest Total Effective Business Tax Rate Oregon Center For Public Policy

Oregon Workers Benefit Fund Payroll Tax

Many Struggling Oregon Businesses To See Tax Hike In 2021 Katu

Or Dor Oq Oa 2012 2022 Fill Out Tax Template Online Us Legal Forms

Frequently Used Screens In Ospa Oregon Statewide Payroll Services Ppt Download

Oregon Workers Compensation Insurer Premium Assessment Report To Department Of Business And Consumer Services Or Workers Compensation Premium Assessment Report Us Legal Forms

What Is The Oregon Transit Tax Statewide Local

Who Is Exempt From Oregon Wbf Tax

Oregon Domestic Combined Payroll Tax Report Oregon Department Of Revenue Pdf Free Download

Fillable Online Oregon Workers 39 Benefit Fund Wbf Assessment Oregon Gov Oregon Fax Email Print Pdffiller

Who Is Exempt From Oregon Wbf Tax

Oregon Workers Benefit Fund Wbf Assessment

Oregon Paycheck Calculator 2022 With Income Tax Brackets Investomatica

Oregon Domestic Combined Payroll Tax Report Oregon Department Of Revenue Pdf Free Download

Department Of Consumer And Business Services Charts Oregon Workers Compensation Costs State Of Oregon

Oregon Combined Payroll Tax Report Pdf Free Download

My Money Map A Complete Financial Breakdown Financial Mechanic

Frequently Used Screens In Ospa Oregon Statewide Payroll Services Ppt Download